We bought our house in 2007 at a purchase price of $219,900. While I was pleased with the price, we had huge sticker shock when we figured out the total between our down payment and thirty years of mortgage payments was going to be $450,000!

After putting down 20% ($44,000), we still had $405,000 left in mortgage payments to make over the next thirty years. I knew there had to be a way to bring that down, so I quickly got to work figuring out how to pay less.

Note: there’s a bunch of mortgage math in this article; for a refresher on the basics, check out my Mortgage Math 101 post.

How does $219,900 turn into $450,000?

Here’s the breakdown:

- Down Payment: $43,980 (20%)

- Mortgage: $405,470

- Principal payments: $175,900

- Interest payments: $229,570

For our home, we paid down 20%, leaving us with a $175,900 mortgage.

At 6.625% for a 30-year fixed mortgage, the total interest paid is $229,570. That’s right - the total interest is more than the actual purchase price of the house.

Such is the nature of buying things you don’t technically have the money for…

Because the down payment and principal payments cover the purchase price (which is fixed), the only flexible number here is the interest payment.

With only that one option, I got to work using the 3 methods I had to bring that interest payment down :)

1. Refinance with a lower rate

Refinancing is working with a bank to “re-do” your mortgage. If interest rates have dropped, you can get a new mortgage at the lower rate.

Lower rate = less interest payment every month

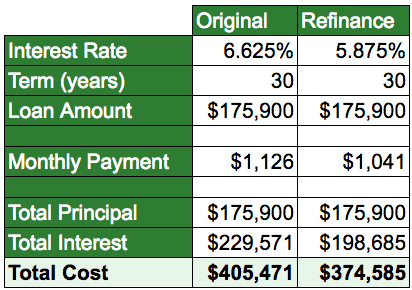

So, our first move on our mortgage was to refinance from a 6.625% mortgage to a 5.875% mortgage. In theory, that gets you this:

By refinancing to a slightly lower rate, we would save roughly $31,000 on the mortgage over the long haul and our monthly payment is lower by about $85!

More money in the long-run and more each month along the way? What’s not to like?

The reality

Refinancing costs between a few hundred and a few thousand dollars. Because we weren’t exactly rolling in cash, we ended up paying for our refinancing by putting the cost back into the mortgage.

That meant that the roughly $1,500 in equity that we had earned since the start of the mortgage was gone.

The other bad news? When you re-finance, you reset the clock on your mortgage payments.

Since we did this 10 months in to our first mortgage, we were now on track to pay our house off in 30 years and 10 months instead of just 30 years flat.

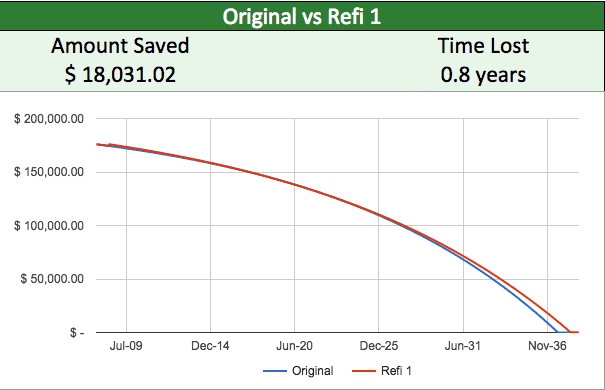

Overall, the decision was still worthwhile, but not exactly glamorous. Here’s what our new “mortgage journey” looked like based on 10 months in the first mortgage and our new refinance plan:

Lesson: refinancing to a lower rate can be a good idea, but you have to be careful of the refinance costs and the additional time tacked on

Dropping our interest payment by $18,000 was progress. This was better but definitely not good enough, so I kept looking for ways to improve our situation.

2. Refinance with a shorter loan

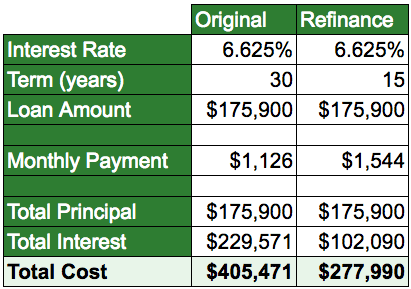

Above, I covered how we refinanced with a lower interest rate as one way to improve your mortgage situation. Our next move was to refinance with a shorter term - dropping from a 30-year mortgage to a 15-year mortgage.

To help explain how this works here’s how things look in a refinance to a shorter term:

All things equal, dropping from a 30-year mortgage to a 15-year mortgage with the same rate cuts the interest by more than half! All that, plus you get done in half the time?

Of course, there’s always a flip side - the monthly payment here goes up quite a bit ($1126/month to $1544/month).

The good news is that reality in this case is often sweeter than the theory.

The reality

The coolest part about doing this is that rates for 15-year mortgages are typically less than those for a 30-year.

In essence, you get the benefit of paying less interest because you have a shorter term plus you are paying less interest because of the lower rate.

We refinanced to a 15-year mortgage at 4.125% after 27 months of the 5.875% mortgage.

Because of the significant rate drop (and a bit of a prepayment, which I’ll cover in a minute), our monthly payment only went from $1041/month to $1200/month.

Month-to-month, $160 isn’t an insignificant amount but it also wasn’t enough to bust our bank account.

The impact was huge:

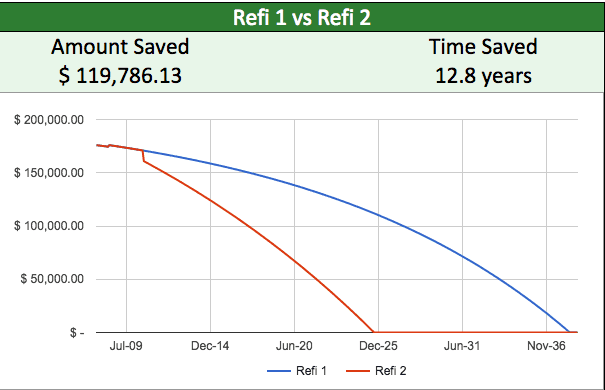

We dropped our total cost another $120,000 and brought in our payoff date by 12.8 years.

Lesson: dropping from a 30-year to 15-year mortgage can have a huge impact on our total cost; that said, do the math and understand what the impact will be on your monthly payment

Going around again

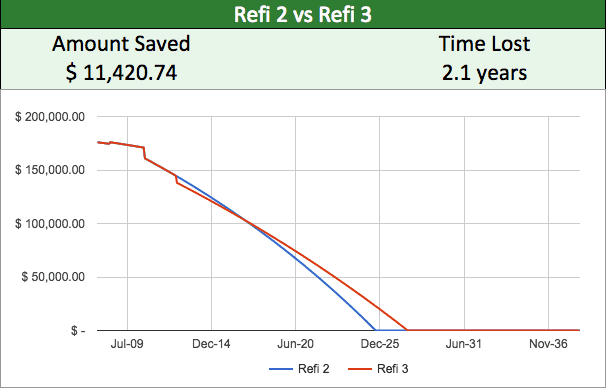

We got lucky that rates kept on dropping so 25 months later we took advantage and refinanced again, this time for a 15-year at 2.75%.

Similar to the other time we refinanced with just a lower rate, we saw another drop in the total cost but we reset the clock.

Overall, still a positive impact in our book:

Another $11,500 saved, but we’re out another 2.1 years on our date.

3. Making additional principal payments (prepaying)

At this point, we’re at probably the lowest rate we’ll see in our lifetimes and in a short timeline (at least as mortgages go).

So from here, there’s only one weapon left in the arsenal to help us destroy our debt - prepayments.

As I said earlier, we’d done this a bit along the way - on our second and third refinances, we paid some extra money in to drop our mortgage amount off the bat by $10,000 and $5,000 respectively.

While that makes sense (smaller loan = less interest), many people aren’t aware of an option that’s available to them to do the same without refinancing - making prepayments.

A prepayment is simply you giving extra money to the bank now in order to knock down your principal payment even further.

An important note here: for most mortgages, this is allowed free-of-charge, but some have prepayment penalties - be sure to check with your lender ahead of time to understand what your mortgage’s rules for prepayment are

Example

Pretend your monthly payment of $1000 is $800 of interest and only $200 of principal early on in your loan.

Let’s be honest - that sucks. You just paid $1000 in hard-earned cash and 80% of it is just going off to never-never-land.

In comes the pre-payment - after you make your normal monthly payment, you pay another $1000 in the same month. In this case, all of it goes toward principal.

The reality

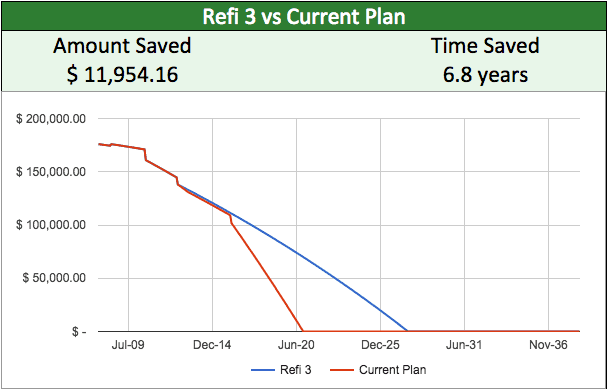

Right after we re-financed to the 2.75% mortgage, our monthly payment dropped from $1200/month to $937/month but we pretended that our payment stayed the same.

We told our lender to continue to withdraw $1200/month and apply the additional $263/month straight to paying down the principal.

The impact on your total interest paid here depends on your interest rate - the lower the rate, the lower the impact of prepayments.

For us, the bigger impact was the reduction of the time it takes to pay off the mortgage.

While we only did the “pretend you’re on the old payment” approach for 8 months (the financial reality of 3 kids under 3 years old set in), we saved about $1,000 and moved our mortgage date up by 3 months.

We’re back on this kick, but hitting hard this time. Because we’ve been so focused on being more frugal the last year, we’ve just put a $6700 prepayment in.

Beyond this, whittled down our expenses by enough to set aside an extra $1,000 a month to go toward the mortgage starting next month.

What’s the impact of that action? We’re going to save about $11,000 more in interest but perhaps more impressive, take another 6.5 years off our mortgage.

Combining this with the prepayments we did for the first 8 months we got:

Lesson: prepayments allow you to knock down your principal extra fast since every dollar of prepayment avoids interest - that said, if you’ve got a low interest rate they don’t make quite as much of a difference

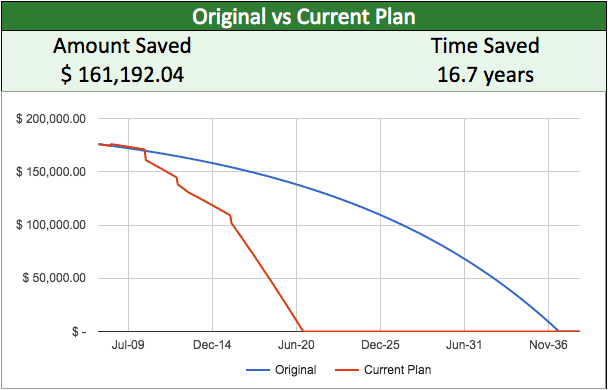

Put it all together

When you put it all together, here’s what our mortgage journey looks like vs what it would have been if we had just stuck with our original mortgage:

Through all the moves we’ve made and what we have planned going forward, we will save over $160,000 and cut our total mortgage time down from 30 years down to 13 years and 5 months.

Looking forward

I expect some may raise questions about why we’re so aggressive about paying off our mortgage rather than using the extra prepayment money for investing.

The short answer is one word: Freedom. By putting this money into our mortgage, we have assurance of when we’ll be debt free and we know that timeline is fairly soon.

Our complete debt-free date: January 1, 2021

It’s crazy to think that we’ll be done with our mortgage payments less than 5 years from now.

The crazier thought is that we’ll have an extra $1936.55 a month to figure out what to do with once we’re there :)

What’s your journey look like?

In the end, everyone has their own path to financial freedom. For us, stop one is complete debt elimination.

Our mortgage is the last piece of that and as you can see we’ve been working hard to finish it once and for all as quickly as we can.

What’s your financial journey look like? Drop me a note in the comments below or tweet me with your thoughts.