We had a toast-worthy moment last week - our outstanding mortgage balance finally came under the $100,000 mark; we’re officially in a 5-digit mortgage!

Much of our momentum on paying the mortgage down can be attributed to the prepayments we’ve made along the way. They are also the primary way we plan to bring our mortgage to zero roughly 17 years ahead of our original mortgage term.

I’ve posted (frequently) on mortgages in the past and I often get the following question:

If you’ve got a 15-year mortgage at 2.75%, why would you pre-pay instead of just investing that money in the market? You’re pretty much guaranteed to make a better return - a good index fund usually gives 8% a year!

Given the big milestone in our financial freedom journey, I thought this would be a great time to celebrate our progress with a detailed answer to that question.

The math

The first thing to tackle in this question is what the math says about the return rate.

The biggest difference between prepaying and investing is a “guaranteed” return (prepaying) vs a “volatile” return (investing).

I know if I prepay the mortgage that I’m going to get a 2.75% return rate on every dollar I put in.

Putting a dollar in the stock market today, however, could yield pretty wildly varying results depending on the amount of time I’m investing over. How can you profile what you’re likely to get in returns to figure this out?

My approach - replay the market

While past performance of the market is not a perfect predictor of future performance, you can certainly use historic stock market data to get a sense for how the market behaves in general over different spans of time.

With our current mortgage balance and the $1000/month prepayments we have planned out for the future, we expect to pay off the last $98,000 of our mortgage in 54 months (that’s just 4.5 years - woohoo!).

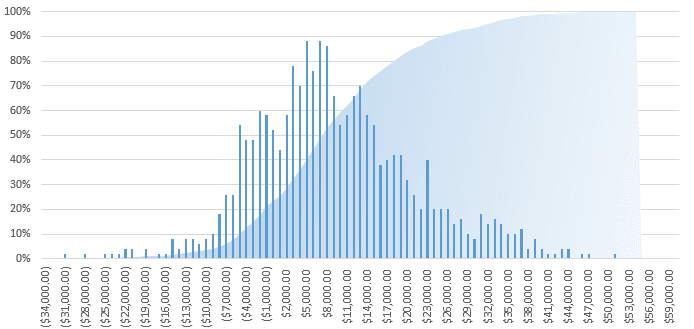

To see what this would look like if we invested that $1000 instead, I created a spreadsheet that models out performance of investing $1000 a month for every 54-month period from 1871 to the present.

In other words, I can tell you from this sheet what $1000/month invested from January of 1871 through June of 1875 would turn into; what February 1871 through July 1875 would be, and so on all the way through the period of September 2011 through March 2016.

Just to make it fun, I even put in taxes on short-term and long-term capital gains and losses where applicable.

By putting all the scenarios together, I can pose the question this way:

If the next 54 months of the stock market behaves like one of the other 54-month periods in history, what are my possible outcomes? How likely am I to be better off investing vs prepaying?

Pretty awesome, right? Ok, yes, I’m a huge nerd.

But look, I got to make this pretty graph:

Interpreting the results

Based on playing out the scenarios, I ended up with the fancy chart above.

The x-axis (on the bottom) shows the different possible outcomes if I invest. If the number is positive, that means investing was the better call by that amount; if it’s negative it means that prepaying was the better call by that amount.

The results are pretty interesting:

- The best-case scenario for investing is that I can pay-off the rest of the mortgage after 54 months and have an extra $55,000. Ummm…yes, please?

- The worst-case scenario for investing is that I fall $33,000 short of paying off my mortgage after 54 months. Yuck.

- If I were to invest, I’ve got a 50% shot of being able to pay off the mortgage and have at least an extra $7,000.

But here’s the big one:

Investing was better than prepaying in 76.6% of the scenarios

Wait, what?

Wasn’t this supposed to be a post about why I’m prepaying instead of investing? I just told you investing is better over three-quarters of the time.

You can probably guess by the fact that haven’t changed the title to this post that I’m sticking to my guns on prepaying. Why?

The mentality

For my personality, the analysis above does a great job of showing the numbers in absolute terms, but there’s a relative value of these scenarios that only you can assess based on your personal risk profile.

Let me try to explain with an example:

Let’s make a bet. We’ve each got a 50/50 shot of winning. If I win, you give me $33,000; if you win, I give you $55,000

Would you take that bet? It’s certainly a better deal for you than me, but are you really ready to shell out $33,000 if you lose?

You’d probably take it if the stakes were $0.33 and $0.55 instead. Why?

The relative downside of losing is pretty low - you can part with $0.33 and not bat an eye. But $33 grand? To me (and many others) that feels life-altering.

For my risk-profile, the relative downside (pain) of losing $33,000 is more impactful than the relative upside (gain) of getting $55,000.

Based on that, I wouldn’t take either side of that bet.

Back to the mortgage example, it’s a bit more complex - we don’t just have two possible outcomes, we have a ton ranging from big losses to big gains and everything between.

When I look at the numbers and consider the relative downside and how much I’d be kicking myself if I ended up $5,000 or more worse off, prepayment feels like the better option.

As much as we think everything can be handled by logic and math, much of investing is about your personality and how you’d react to the different scenarios.

Is prepaying right for you?

Pre-paying your mortgage, like most investment strategies, is largely a question of risk tolerance. You’ve got to decide what downsides you’re willing to risk in order to have a shot at the upsides.

If you like rolling the dice (or just have a lot of money already), investing certainly has an upside.

That said, don’t assume that the “8% return” of the market is a sure thing; over shorter periods of time it can vary quite a bit.

Before you make any major financial decision, do the math and know your mentality! (Tweet this)

Thrift on, rockstars!