I spent $3,200 today. That’s not a typo - it was a spendy day. For a relatively thrifty guy, you’d think dropping this kind of money would cause heartburn or stress. Not now. Years ago, though? That’s a different story altogether.

Long ago, in a Middle School Far Away

I was in 6th grade when I set my sights on my first big purchase. Sure, I’d had an allowance and bought some small toys or candy, but this was the first thing I really saved for. I knew it wouldn’t be easy. This was the early 90’s and I needed to save $200.

This is back when minimum wage was $4.25 an hour and I was too young to really be employed. I was making a few dollars here and there from watching neighborhood kids but finally saw real money roll in when I started picking up garbage in parking lots.

Even at that point, I was only making $20 a week.

But I was going to slog it out - to put at least half of whatever I earned in my savings account until I had enough to buy the treasure I knew would make my life complete…

After months of saving, I finally had just over $200 in my savings account. My oldest brother drove me to the bank to make my first big withdrawal.

I remember the feeling of standing in line waiting to go to the counter. My palms were sweating, my stomach was in knots and I had an intense tightness in my chest. This was more money than I had ever seen and I was about to take it all out in cash and spend it. We withdrew the money and I asked my brother to carry it. It seemed too much for a 12-year-old to hold.

We arrived at best buy, got the boombox and put it in the cart. I don’t even remember checking out, unpacking the boom box, or listening to my first song on that bad boy. I just remember how stressed out I was about spending this much money.

Fast Forward 23 years

Fast forward to last Saturday. At about 11 AM, I walked upstairs feeling a bit cold to check our thermostat. This has become a habit of mine as we’ve had so many issues with our furnace in the 10 years we’ve lived here.

Sure enough, I saw that dreaded multiple-degree difference between what our thermostat was measuring and what our house is supposed to be at.

With all the issues we’ve had, I can do enough troubleshooting on our furnace to get it working again about half the time but this time I was having no luck. I called the local furnace guys we trust and asked them to come out to take a look.

Over the past 10 years, we’d had this furnace go out at least 8 times and every time it was a $100-$300 fix. This time was different - the diagnosis was conclusive. Our furnace was dead for good this time.

It took about 48 hours from time-of-death until we were able to get the new furnace installed. We thanked God for the friends that loaned us a space heater and invited us over to hang out in a warm space. At worst, the house dropped to 57 degrees. It’s amazing how warm that sounds when it’s in reference to outside temperatures, but when you’re talking about the inside? Brrr….

When I got the bill from the furnace installers at the end of their job, the total was just under $3,200. I wrote them a check, handed it to them and wished them a great evening.

No knots, no sweaty palms, no tightness in my chest.

Starting from Scratch

So why was I able to drop several thousand dollars with ease when I struggled buying a $200 boombox?

It’s not that I’m older and wiser. I’m definitely older. What was the other part?

It’s not that I really wanted to buy a new furnace. I had to buy a new furnace. The boombox, on the other hand, was something I really wanted to buy. Something I thought would bring me immense joy once I had it (incidentally, I was correct - it did)

It’s not that $3,200 is insignificant for us based on our current finances. It takes months to put away that kind of money - much longer than it took to save for my rockin’ middle-school boombox.

It’s that there was something fundamentally different about the state of my finances when I bought that boombox. I know what could recreate that same painstaking feeling I had in the line at the bank two decades ago.

The stress came from the pain of starting from zero all over again. (Tweet this )

When middle-school me pulled that $200 out of my savings account, I was effectively broke again. Not in the true sense - my parents gave me shelter, food, and anything I really needed. But I was starting from scratch on my goals.

Even it if it was just money for my goals, I was broke.

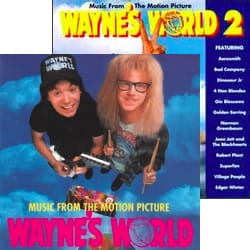

My next goal quickly appeared. A boombox with a CD player is much cooler with actual CDs to play, so I started my savings over again. I picked two top-notch CDs that I knew I would love.

It only took a few weeks this time but then I was goal-broke again.

I was getting what I wanted, but I still felt stressed.

Building a Buffer

We have a recurring mantra in our house - “We can buy anything we want - as long as we’ve saved for it first”.

While it wasn’t conscious, I’ve worked over the last two decades to prevent myself from getting in that same state of starting from scratch.

The reason I didn’t blink an eye at writing a $3,200 check today? Because even after the money came out of our emergency fund, we still had more than enough to cover another emergency.

We had a family visit to the ER last month. The bills that have come in so far total $1,500 but I’m not freaking out. Our HSA had more than enough to cover these and we’ve still got enough to cover our out-of-pocket maximum for the year.

We’ve learned over the years that stuff happens. Houses need maintenance; health events happen. You’ll have to spend money you didn’t plan on once in a while.

There’s not much worse than having an unexpected expense and knowing that one more thing would push you over the edge. The key is to leave yourself a big enough buffer so you don’t have to start from scratch.

There’s no perfect science on how to do this, but you can at least take some reasoned guesses.

- For issues with your house or car, understand what your insurance deductibles are and make sure you’ve got enough to cover both

- For healthcare, ensure you can cover your out-of-pocket maximum for at least one year

- For appliances, have enough to cover a failure of the two most expensive ones

Setting the bar at these levels gives you enough buffer that you can breathe even after making an unexpected payment.

It Works for Goals Too

The boombox wasn’t an emergency. It was a goal and yet I still felt stressed because I had to start from scratch.

When we plan our financial goals now, we’re usually working one to two steps ahead. Other than topping off emergency savings (if needed), our annual family road trip is at the top of the list every year. We have that trip saved for and paid for well before we take it.

This gives us the freedom to feel great when we spend $3500 on a two-week trip because we know that we’ve not only covered that amount but that we’re already partway to our next financial goal.

Build Your Buffer

As you work toward your financial goals, building a buffer might seem impossible. You haven’t even covered your first step - how can you expect to be working on the second?

First thing’s first - get your emergency fund set up. Until you’re there, you’ll always have that stress of

Once you’re covered for emergencies, here’s a trick to make things work for your goals: delayed gratification.

Once you’ve saved for your first goal, wait 1-month before actually going through with it. Keep on saving during that month, putting the money toward your next big goal.

By doing this, you’ll already be looking forward to your next goal so you can avoid having an “after-purchase crash”. In addition, that one extra month of savings will do wonders for your stress level and will keep you from feeling like your financial gas tank is running on empty.

How do you feel when you make a big purchase? Is it an adrenaline rush of joy or a stressful event? If you’ve managed to tame your emotions around spending, how have you done it?