As we’ve been speeding toward closing on our house and downsizing into a rental, I’ve been thinking a lot about how we’d make the rent versus buy decision if we were already financially independent. There are lots of great articles in the personal finance world that examine the trade-offs between renting and buying but I haven’t yet stumbled across one that looks at it from the perspective of someone who’s already covering all their expenses from retirement savings accounts. Let’s fix that.

First, a couple key considerations in the comparison:

If we rent, our annual expenses will be higher but we’ll have a whole bunch more capital available because we won’t have that money locked up in equity in our house.

If we own our home, our annual expenses will be much less; with no mortgage, there’s no regular monthly payment. That said, we’d still have to pay property taxes, homeowner’s insurance, and keep some money on-hand for maintenance and upkeep.

A Hypothetical Scenario

With all that in mind, let’s pretend for a moment that you are crazy rich and moving to a new town. You have to decide whether or not to buy a house (outright, with no debt) or rent.

A lot of people have probably already picked an answer at this point, but I’d caution you against being so hasty. Any answer to a scenario like this without looking at the numbers is just going to be based on personal, biased experience and beliefs.

That’s not how we roll around here. Let’s take a look at how to model this decision and ultimately crunch the numbers in a spreadsheet :)

How to Model Rent vs Buy for FI

The crux of making a valid comparison here is to use one of my favorite financial independence concepts - the safe withdrawal rate.

For those of you not familiar, the safe withdrawal rate is the amount (as a percent of the total) that you can take out of your retirement savings account every year without ever running out of money.

While there are no guarantees, the general consensus is that 4% is a pretty safe pick (or 3.5% for the conservative folks out there). This number builds in both inflation and expected investment returns for a reasonably balanced portfolio.

One of my blogging buddies - Ty over at Get Rich Quickish - flipped the concept of the safe withdrawal rate around to figure out how much you need to save to cover individual expenses in retirement.

We can use this same thinking to convert a home purchase with other annual expenses (insurance, property taxes, etc.) to a “housing retirement balance” that you’d have to set aside to cover the purchase and annual costs of buying a house. On the flip side, you can use that same balance to calculate what annual rent you could afford using the safe withdrawal rate.

With this model, if you know the cost of a home and the monthly and annual expenses associated with it, you can calculate the equivalent rent you could generate from your retirement portfolio.

Comparing the quality of real rentals at that cost with the home in question should give you a really solid understanding of whether renting or buying is the better choice for your situation.

Got the theory? Great. Are you ready to see how this works in action?

Awesome, because it’s spreadsheet time.

The Rent vs Buy for FI Calculator

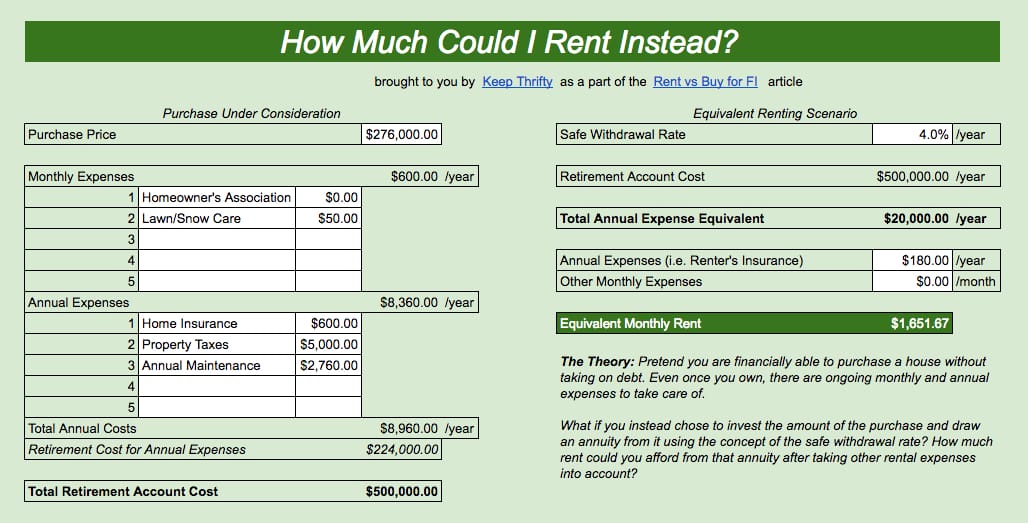

Go ahead and check out the Google Sheets spreadsheet for calculating the equivalent rent of a home purchase using the safe withdrawal rate. If you own a home, go ahead and plug in your numbers and see what your equivalent rent would be.

To help illustrate, let’s run through the calculator with my personal situation.

My Rent vs Buy Scenario

We are in the process of selling our current house for $276,000 and moving into an apartment in the same town. As a homeowner, I’m currently responsible for lawn care and shoveling the driveway but won’t have to do this in the rental. As such, let’s pretend I splurged on a $50/month service to take care of these for me in our current house.

In addition, our home owner’s insurance runs around $600 per year and property taxes in Wisconsin are painfully high at $5,000 per year. I’m presuming a 1% per year cost of maintaining the home, so that comes in at $2,760 per year.

All included, the calculator rolls these up into a nice round $500,000 retirement nest egg just to cover our housing in this house.

If I convert this back to the equivalent rent using a 4% safe withdrawal rate and $180 per year in renter’s insurance, we could afford just over $1650 a month in rent with that same half-a-million-dollar nest egg.

In our area, that’s fairly comparable to the house we live in. I’d anticipate if we had tried to rent our house out that we could have gotten roughly $1600-1700 a month for it. For a similar house, the rent versus buy question is a toss-up.

More importantly though, we can learn a lot by looking at our actual plans - including downsizing.

How does this compare to what we’re actually going to spend in our smaller apartment?

I thought you’d never ask :)

We’ll only be paying $975 a month - that’s $675 a month less than what our hypothetical retirement housing allowance would allow!

Doing the math, we’d only need $300,000 in our housing retirement account to finance our downsized housing for the rest of our lives.

Using this model helps show the financial power of our move to downsize. If we can maintain our lifestyle in our downsized state, we could cut our needed retirement savings by $200,000 (that’s 40% less).

That’s pretty powerful.

How do your numbers look? Does this make you look at the rent versus buy debate any differently?

If you’re looking for ways to minimize your rent, check out this cool article from The Hidden Green: “The Definitive Guide to Cheaper Rent“