This article contains one or more affiliate links. We only link to things we support and think you could find useful. If you pay for something you clicked on in this article, we may get a commission as a result.

My first experience with life insurance may sound familiar to you. I graduated from college and started my 9-5 job, which offered a basic policy as a part of my compensation. I was also given the option to purchase additional insurance at a discount through paycheck deductions.

Being 22 and having few responsibilities in the world, I spent probably a total of 28 seconds considering my options. Between my company’s contribution and my own, I would be covered for 3.5 times my salary. I checked to make sure the deductions wouldn’t cramp my lifestyle and clicked “enroll”.

Like a Ronco Showtime Rotisserie, my attitude was set it and forget it (Tweet this )

But life changed a lot in the years after that decision - I got married, bought a house, had kids, and made the decision to operate as a single-income family.

Would “3.5 times my salary” have covered our family’s needs through all of those changes? If I had died, would Jaime have been able to cover the cost of raising three kids in our house?

Fortunately, we never had to test those questions.

This month, the life insurance policy with my former employer expired, so I got the chance to act a bit more grown-up and handle life insurance better.

Figuring out How Much Life Insurance I Really Need

Getting a chance to start from scratch, the biggest thing I needed to figure out was how much life insurance coverage I really needed. With a mini-retirement income of $0/year, I certainly couldn’t just apply a multiplier :)

So how do I figure out what I actually needed?

I used the approach I read about it in The Wealthy Barber. You could summarize it like this:

Visualize life for your loved ones after your death and write down everything you’d want to provide for them

This approach seems so common sense that you’d think everyone would be doing it. But I suspect a lot of people out there just take the “multiple of my income” approach and run with it.

So, this time around, here’s what I did:

First, I wrote down everything I’d like to cover for Jaime and the girls in the event of my untimely death. I assigned dollar values to each.

- Pay for a cremation funeral.

- Be able to build a house on our land or, if I die after we’ve built, pay off the mortgage immediately.

- Bump up our kids’ savings accounts to $25,000 each - this is “gift money” we have planned for them for their future (wedding, home down payment, etc.)

- Provide Jaime with enough money to be financially independent.

Second, I wrote down what I’ve already got covered through savings, home equity, social security, pensions, and investments.

- My current 401k and Roth IRA balance

- Kids’ current savings account balances

- Pension payments from my former employer for Jaime when she’s retirement age

- Social security payments for surviving children and spouse caring for surviving children

- Social security payments for surviving spouse once Jaime’s at retirement age

For social security, there’s an awesome calculator here to help you figure those last two out. If I died tomorrow, social security would step in and provide enough to cover annual expenses for years.

Third, I calculated the difference to see how much we needed

This one may seem simple at first, but it can get a bit tricky because of the timing of different income streams and expenses.

Your insurance check may clear shortly after your death, but how do you figure out the impact of social security or pension payments that are 30 years down the road? (Tweet this )

If you know me well, you’ll know there’s a spreadsheet.

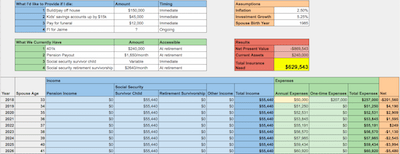

I used a spreadsheet to make “Net Present Value” calculations for everything - that is, turning all those future events into dollars today.

If you’re curious, you can see a copy of the spreadsheet on Google Drive here.

The sheet is set up for our personal situation as an example. You may or may not be able to plug your own situation and values in easily. That said, you should be able to poke around in the formulas enough to see how everything works together and create your own version.

The sheet uses the XNPV function to calculate the “present value” of all the cash flows (in and out) from now until Jaime turns 100. I built in inflation of annual expenses (but also a hopeful reduction of expenses when the girls each graduate college).

Net present value hinges on applying a “discount” rate. In this case, it’s really an estimate of how the stock market will perform over the duration of the scenario. I used a discount rate in the formula of 5.25%, representing a really conservative estimate of stock market returns.

Why conservative? Because you don’t want your surviving family to be short money because you were too optimistic about the market!

In the end, our magic insurance number was: $629,543, which I rounded up to $650,000

Picking Term Life Insurance vs Whole Life Insurance

Whew! The math and spreadsheetery there was intense, but we got through it.

Next, I had to choose what kind of policy I wanted - Term Life or Whole Life.

My opinion is this: Whole Life insurance is just a way for insurance salesmen to sell you two products instead of one.

Term insurance is life insurance.

Whole life insurance is life insurance plus an investment account. And the returns on that investment are generally worse than you could find by investing on your own.

If you want to dive into the details, White Coat Investor has a great post on why you should avoid whole life insurance.

So, needless to say, I picked term insurance.

Picking the Term for my Life Insurance

The “term” part of Term life insurance is the length of time that you’re locked into your rate. Once that period is over, your insurance expires and you have to reapply (likely at a much higher premium).

Shorter terms tend to have cheaper premiums; longer terms tend to have higher premiums.

So, how did I pick?

I’d like this to be the last time I need to buy a policy. With that in mind, I wanted to pick a term that covered me until I wouldn’t need insurance anymore.

So, I picked 15 years.

Why 15? By what we anticipate, I think we’ll be financially independent in 15 years - at which point life insurance becomes unnecessary. After all, life insurance is meant to provide income as a replacement for the person being insured. Once we’re financially independent, our income will all be passive anyway!

Picking a Life Insurance Company

Searching “buy life insurance online” gives roughly 4 million results on Google, so the landscape can be a bit daunting.

I spent about 30 minutes doing online quotes and found premiums all over the place - ranging from $20 a month to $80 for the same policy!

The winner of my scenario was Haven Life. The online application process was easy enough and the premiums were the lowest I could find.

(A special shout out to Chris from ApathyEnds for telling me about Haven Life - I hadn’t heard of them before!)

Policies for Haven Life can go all the way up to $2,000,000. If you’re looking for a policy of $1,000,000 or less, you probably won’t even need to do a medical exam.

I did need to do an exam for my application, but I think that was because I put in an income of $0. It was an accurate answer for this year, but it meant I had a bunch more questions to answer.

If You Need a Medical Exam

Haven Life covered the cost of the exam and the whole process was quick (about 15 minutes) and painless.

Ok, maybe not completely painless - I felt a small poke for the blood draw :)

They took measurements for my weight, height, and blood pressure and sent my blood samples off for analysis. After about a week, I got an e-mail with a full, comprehensive health analysis showing a clean bill of health and approval for the policy.

I don’t think I’ve ever had a blood panel cover so many measurements before, so it was cool to see the results.

So, after a bit of effort, math, and blood, I’m now insured and comfortable that Jaime and the girls will be well covered financially if anything were to happen to me!

Other Considerations

I was talking with a blogger friend, I Dream of FIRE, and he had some life experience with insurance that I thought worth sharing.

He advised that people err on the high side for both coverage and term length. Again, once you lock in the amount and term, you can’t (for most companies) change those unless you go through the application process all over again. By that time, you’re a bit older and your premiums would go up significantly.

In addition, if you have any significant health issues come up, premiums on a new policy can be significantly higher.

In essence, he encouraged people to lock in an expensive policy with a long term when you’re young and healthy. Do so and you could save a ton of money over the long haul!

On Being a Responsible Grown-Up

I have to admit, I’m pretty embarrassed about how I approached life insurance before this go-around.

As it turns out, the “3.5 times my salary” policy would have been woefully inadequate for what I would have wanted to provide for Jaime and the kids.

Jaime’s tough, so I know she would have figured things out, but I feel a lot better now knowing what I can provide for my family even if I’m not here!

How do you handle life insurance? How did you pick your insurance coverage and term? Or do you have a whole life policy and want to debate the merits?