So much has and is changing in our finances this year. Chris is back to having a regular paycheck. We will move out of our apartment this Summer, move into our new house, and be back to having a mortgage. While we aren’t excited about the mortgage, we are thankful to be able to build our dream home, the Little White Shack.

We definitely want to pay off our mortgage as soon as possible. I know we will be tempted to take every extra cent and throw it at eliminating this debt. For some people that is the right decision, but I want to make sure that we don’t neglect our other values, mental sanity, or relationships in the pursuit of debt freedom.

For us, this means contributing to charities we believe in, investing in travel, and spending money hosting dinner with friends. Sure we could postpone these things and pay off our mortgage crazy fast, but it would leave us feeling empty. That’s not what we want.

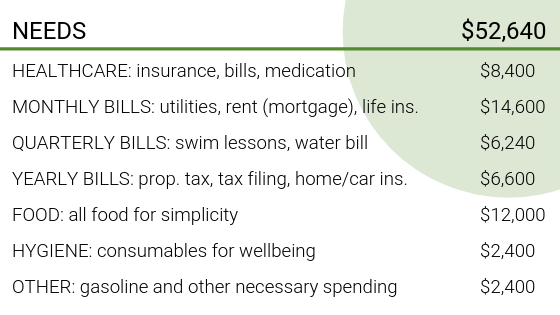

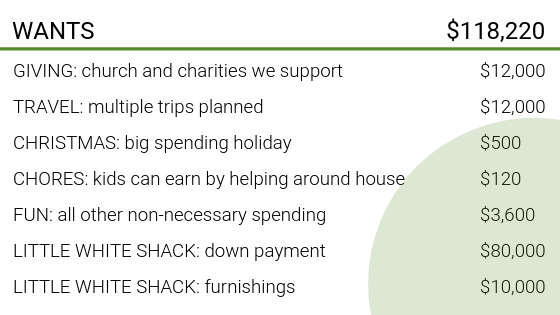

With those things in mind, we are creating a general spending plan for the year. To help wrap my mind around all the different types of spending that come up throughout the year, I divided each category into one of two groups: needs or wants. And since we have been tracking our spending in Thrifty for over 3 years, it was fairly easy to come up with spending estimates. Here is our plan:

This brings our total spending plan to $170,860. This definitely isn’t a normal year for us, mostly because we are building our house. The $90,000 for the Little White Shack has already been saved up, so that won’t affect our bi-weekly paycheck. Along with that, some of our healthcare costs are covered via Chris’s employer ($3,240 healthcare premium) and an HSA account ($2,890 balance remaining as of January 2019). When you take these expenses out of our total, our spending plan is $74,730!

Halfway through the year, we’ll let you know how we are doing! We’ll tell you if we estimated any category wrong, over-spent, under-spent, and where we land on our mortgage!