We handled our finances differently during our Mini-Retirement. We had set an annual budget and deducted from that amount each month. Now that the mini-retirement is over and we are back to receiving a paycheck, we want to get back to a healthy monthly budget.

This kind of stresses me out. I mean, budgets can be complicated! When things get complicated I curl into a ball and have a hard time moving forward. Over time, I’ve found the best way to uncurl myself is to break the complicated into small easy tasks.

That’s what I’m going to do with our budget now. I’m not going to take it all on right away. I’m going to take on a small category (or small cluster of related categories) one at at time. I’ll dive into how we’ve spent our money in that category and how we want to adjust our spending.

The following month I’ll share how we did and any further adjustments we want to make. I’ll also add in a new category to tackle. By taking on a single category at a time and building from there, I’m hoping we’ll have a refreshed budget for 2019!

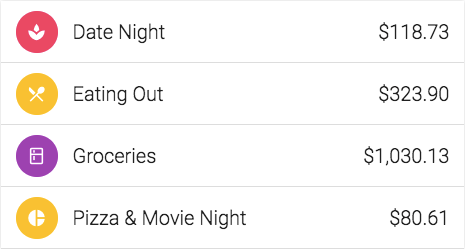

Pizza and Movie Night is an important tradition in our family. Friday nights are traditionally reserved for ordering pizza and ice cream from our favorite pizza place. Originally, this was a 16 inch pizza with one topping and 2 pints of ice cream. Then we added in a large order of breadsticks. And more recently, we added a 10 inch gluten free veggie pizza (I was trying to go gluten free). This increased our weekly Friday dinner cost from roughly $35.00 to $53.00!

When I think about it - we don’t need to consume that much food. While I like being gluten free, it’s not worth $15. Nor do I need a separate individual pizza. We also usually have leftovers. I would love to get back to the basics here. For October, we are going to try ordering the single topping 16 inch pizza and a single pint of ice cream. This will bring our weekly budget down to $27 (monthly $108).

We have also switched from renting a movie from the library to renting movies from Redbox in the hopes that we can get a more current movie we can all enjoy. We will probably continue this, but I would like us to limit it to a single movie per Friday. This will cost 1.85 (monthly $7.40)

Date Night is something that Chris and I have budgeted for in the past, but find that we usually don’t make it happen. When we do, it hasn’t always been worth the money. This past month we went out a on triple date that cost us $120 (totally worth it). Seeing as this isn’t a regular occurrence though and we don’t enjoy spending on regular dates, I don’t want a regular monthly budget for this. I would rather have a weekend getaway with Chris and a some extra wiggle room in our overall budget for the random triple date!

Eating out is something we have wanted to minimize over the years. We saw it as a waste of money when we ate out instead of making our own meals. On the flip side, we ate out a few times with friends this past month and I feel that was money well spent! With this in mind, I want to make sure that we have a budget for eating out with friends because it’s an investment in friendship. For October, I’m budgeting $100 for friendship investment!

Our Grocery budget was also way higher in September than normal. Some of this was wasteful and some was stocking up on pantry items. I want to focus on buying more non perishables in bulk so that when we are feeling tired we can gather the energy to make a quick pasta dinner instead of grabbing fast food or pizza. I’m also going to try to cut out the waste. Hopefully I can get back to a monthly budget of $800.

If we can make these changes, we will end up spending $1015.40 on these categories. This would allow us to divert over $500 towards a weekend getaway!

Do you need to refresh your food budget too? Is there a food category you spend money on that you feel is a waste or very valuable to you?