Whatever your goals are in life, there’s a reasonable chance that money plays an important role. Whether it’s having enough to fund a dream vacation, taking a one-year mini-retirement, or reaching full financial independence and retiring early, understanding your finances is key.

I’d go as far as to say that tracking your spending is one of the most important activities you can do during your journey to achieving your dreams.

With input from my twitter followers, here are the five biggest reasons everyone should track their spending:

1. To understand what you spend

Now you know. And knowing is half the battle.

G.I. Joe

Let’s start with the most basic answer - by tracking, you have the ability to actually measure your spending.

That measurement lets you know whether you’re spending more in a month than you are bringing in and it lets you compare your actual spending to a budget (if you’ve got one).

Tracking also gives you an early warning system about “leaks” in your spending habits.

Tracking is knowledge and knowledge is power.

But knowledge isn’t much good if you don’t put it to use. Tracking can get you a whole lot more if you do it right. Let’s see how.

2. To reduce what you spend

That which is measured gets managed.

Peter Drucker

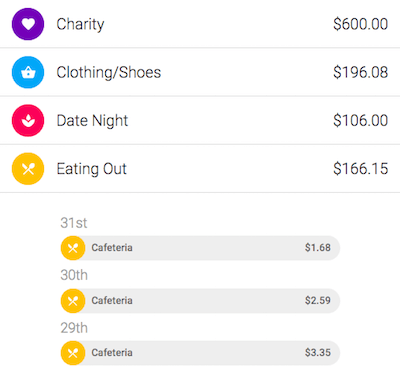

Tracking gives insight into areas of opportunity - areas where you don’t realize how much you are spending until you see the total in big bold numbers.

Knowing how much you spend on different categories can help you turn savings in those areas into a game. Can you beat your utility bill from the prior month?

Customizing how we tracked our spending to separate out “good” spending from “bad” helped us drop our grocery bill by $275 a month. Not too shabby, eh?

Beyond this, tracking can even passively help reduce your spending by acting as a deterrent. Let me explain:

In dieting, using a food journal can discourage you from scarfing down a free donut in your Monday morning meeting. Having to write down that you consumed 350 empty calories doesn’t feel that great.

In finances, tracking your spending can have a similar effect - discouraging you from making those frivolous purchases. Do you really want to have to enter the $20 you blew on lottery tickets this week?

3. To build a budget

If you don’t have a budget already, tracking is a great place to start. Using your “actuals” as a starting point and figuring out where you can improve is a whole lot better than plugging random numbers in a spreadsheet and crossing your fingers.

Tracking your spending is necessary to build an accurate budget because it can help you answer the tough questions:

- My trips to the vending machine don’t really add up to that much, do they?

- What “occasional” or annual expenses am I forgetting?

- How much did I spend this year on “one-offs” that I probably won’t spend again? (or will I…)

Before jumping into our one-year mini-retirement, we used 18 months worth of our spending data to build out an accurate mini-retirement budget.

Because we used actual spending data, we had a high level of confidence that we could actually meet our budget - something that’s critical when taking a big financial leap.

4. To estimate expenses for the future - in particular, retirement

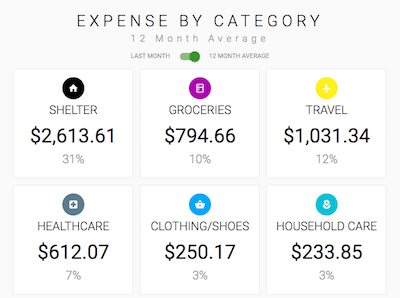

Beyond building a budget for this month or this year, tracking your spending can help you build a budget for when you permanently retire.

After all, to retire you’ll need to know that your investments are going to reliably cover your annual spending.

Investment firms often advise you to figure this out by applying some multiple of your pre-retirement income, but that doesn’t make any sense, does it?

If you make $100,000 a year before retirement but put 50% of that every year into savings, you’re going to need a lot less in your retirement accounts than someone who only puts 5% a year into savings.

(Snide aside: of course they advise you to do this - it encourages you to invest more than you need, which means they get to charge you more.)

By tracking your spending, you can use those numbers to build a realistic post-retirement budget so you can retire with confidence.

5. To align your lifestyle with your values

Finally, tracking can help you understand (and adjust) how well your lifestyle reflects your values.

If you keep saying that travel is really important, but can never seem to afford to buy a plane ticket, maybe you’re subconsciously putting other short-term things higher on your values list.

By tracking, you can find these mismatches and finally stop depriving yourself of the things that you truly want.

We’ve used this to free up more money for our family road trips and our recent trip to Hawaii by spending less on home decor and eating out.

How we track

One of the most important tools in improving your finances is a tracking method that works for you.

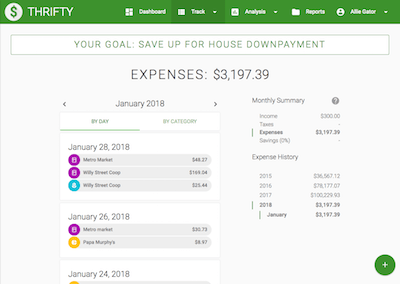

We’ve created a web app (called Thrifty) to helps you track your income, taxes, spending, and savings.

We designed Thrifty as a manual tracking tool because manual tracking helps you get a deeper understanding of your finances and can even act as a deterrent from frivolous purchases.

Every time you spend something, you’ll see the immediate impact to your monthly total in Thrifty.

That view is powerful. We know - we’ve been using Thrifty for over two years and it’s helped us immensely in improving our spending and our overall life.

Want to learn more? Click here to learn more and see if Thrifty is right for you.

Do you track?

So, do you track your spending? If so, what do you use? Thrifty works great for us, but I’d love to hear if you’ve got a different method that works for you.